info | details | screenshots | testimonials | FAQS

DepreciationWorks® support and sales frequently asked questions

Support frequently asked questions:

Yes. The DepreciationWorks data can be copied to a server. To copy DepreciationWorks’ data to a server:

- Run DepreciationWorks.

- The data is in a folder named Data. The current Data folder’s path is displayed in DepreciationWorks’ title bar and in the lower right status panel. (The default installation path is Documents\DepreciationWorks Database\Data. Make a note of the current DepreciationWorks data location.

- Close DepreciationWorks.

- Open My Computer or the Windows explorer and navigate to the current Data folder.

- Copy (do not Move) the Data folder from your local drive to a folder on a server. Be sure you have both read and write permissions for the Data folder on the server.

- Run DepreciationWorks.

- At the Welcome screen, click main menu item File – Change data path. Drill down to the Data folder on the server. Click OK. DepreciationWorks is now connected to the Data folder on the server.

Download DepreciationWorks and install it on the new computer. Downloading and installing will ensure you have the latest version of DepreciationWorks. Other users should also be sure they have the most recent version. If other users don’t have the latest version they should update.

DepreciationWorks installs as a trial on new computers. Receive a key by emailing support@depreciationworks.com with the new computer’s DepreciationWorks hardware fingerprint.

If the DepreciationWorks data is on a server, run DepreciationWorks on the new computer. At the Welcome screen, click main menu item File – Change data path. Drill down to the Data folder on the server. Click OK. DepreciationWorks is now connected to the Data folder on the server. Be sure the Data folder on the server has both read and write permissions set for your user account on the new computer.

If the DepreciationWorks data is on your local drive, consider copying your Data folder to a server. The server probably has scheduled backups and it is a good idea to have the DepreciationWorks data on the server for backups. For more information see the answer to "May I put DepreciationWorks' data on a server?" above.

There are two ways to migrate data if you prefer DepreciationWorks' data to reside on the new computer’s local drive.

Use DepreciationWorks backup and restore:

- Run DepreciationWorks on the old computer.

- At the Welcome screen, make a backup of the DepreciationWorks data using main menu item File – Backup database. The old computer’s backup can be used in a restore operation on the new computer.

Copy data from the old to the new computer:

- The old computer’s DepreciationWorks data is in a folder named Data. The old computer’s DepreciationWorks Data folder’s path is displayed in DepreciationWorks’ title bar and in the lower right status panel. (The default installation path is Documents\DepreciationWorks Database\Data. Make a note of the current DepreciationWorks data location.

- Close DepreciationWorks.

- Open My Computer or the Windows explorer and navigate to the current Data folder.

- Copy (do not Move) the Data folder from the old computer’s local drive to a portable drive and take it to the new computer and mount it.

- On the new computer, open My Computer or the Windows explorer and navigate to your Documents\DepreciationWorks Database. Rename the existing Data folder to DataInstall.

- Copy (do not Move) the Data folder from the portable drive to the DepreciationWorks folder you added to your Documents folder on the new computer.

- Run DepreciationWorks.

- Confirm that your data location is correct.

- Navigate to Companies – Company Data and confirm the data is there.

Delete an asset by pressing the minus key ( - ) on the navigator bar. A dialog box will ask you to confirm or cancel the deletion. Deleted assets are entirely removed from the database and can't be recovered. Delete an asset when it was entered by mistake and never belonged in DepreciationWorks in the first place.

Retire an asset by entering a retirement date for the asset. During year-end closing, retired assets will be archived in a separate table. View prior year retired assets at Asset Maintenance - View Retired Prior Years/Restore.

Sales frequently asked questions:

Yes. If 30 days isn’t enough time, please request additional evaluation days. Extensions of 10, 15, 21, 31, or 45 days are possible.

Request additional evaluation days by email to support@depreciationworks.com. Include the following information:

- DepreciationWorks hardware fingerprint

- Name (first and last) and position

- Company name, mailing address, and telephone number

- Number of additional days requested

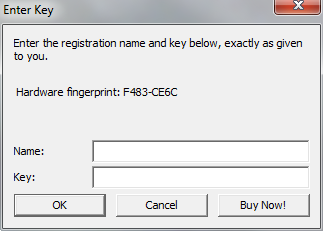

The DepreciationWorks hardware fingerprint is in the Enter Key screen. Upon DepreciationWorks starting in the trial mode, the Reminder form will display. Press the Enter Key button on that form. The hardware fingerprint is case sensitive. Highlight it with your mouse and copy and paste it, CTRL + C and CTRL + V, respectively, into your email. DepreciationWorks will email a name and Key to extend the evaluation 10, 15, 21, 31, or 45 days.

The Enter Key screenshot below shows a sample hardware fingerprint.

A company should establish a depreciation policy and follow it. A depreciation policy includes a part year convention, a choice of a depreciation method for each type of fixed asset, an estimated useful life for each property type, and guidance on determining the general ledger accounts and estimated salvage value for each property type. A depreciation policy should also state a minimum capitalization amount.

DepreciationWorks facilitates the maintenance of a depreciation policy. A part year convention applies to the company. A depreciation method can be set as the default method for a property type. A default useful life can be set for each property type. Each property type can be assigned an estimated salvage value as a percentage to be applied to that type of property’s cost. Once the defaults are assigned, select a property type when adding an asset. The default salvage, method, and life will enter automatically, as well as the general ledger accounts and business property tax category.

Depreciation for the purpose of determining federal taxable income is not depreciation per GAAP. Tax laws may or may not be consistent from year to year. Tax depreciation methods presently ignore salvage regardless of whether salvage is material. Useful lives determined by statute do not consider how long a particular asset may actually be useful to a particular company.

Under Generally Accepted Accounting Principles (GAAP), depreciation is the allocation of the cost of fixed assets (less salvage value, if any) to expense over their estimated useful lives in a systematic and rational manner. The goal of depreciation methods is to rationally and consistently match revenue and expense by allocating the cost of fixed assets over their useful lives. Depreciation methods that provide rational, systematic, and consistent allocation of fixed asset costs to expense over their estimated useful lives are GAAP, or book, depreciation methods.

Arguments in favor of booking tax depreciation rest on materiality, disclosure, and considerations of the cost and benefit of instead using GAAP methods. DepreciationWorks' opinion is that when tax methods are used instead of book methods, materiality needs to be considered for each reporting period and disclosure is a burden. The benefits of using GAAP depreciation for book are that it doesn't need additional justification or disclosure, there are fewer surprise adjustments to net income, reconciliations are less work, and DepreciationWorks' summary reports reduce the time it takes for income tax preparation.

If not obsolete, they are redundant. Income tax preparation software is fully able to do tax depreciation. Yet many tax preparers use separate depreciation software to calculate depreciation and then enter that calculation as a summary total into income tax preparation software. Little time is lost because preparers don't enter the asset records twice.

However, tax preparers pay twice for calculation power they use only once. They do so because income tax preparation software generally doesn't provide an audit trail while separate tax depreciation software does.

DepreciationWorks provides an audit trail. Income tax preparation software can calculate tax depreciation using asset cost totals by property type and month in service. DepreciationWorks provides summary totals of asset cost by property type and month in service such that there is no need for separate tax depreciation software.